MFG #12: AfriChange's Onboarding Problem, Trigger Events & More.

Why N300k wasn't enough motivation to undergo AfriChange's onboarding, why you should identify users' trigger events, and more.

Hi there.

Welcome to the 19 new subscribers that joined Marketing For Geeks since the last issue. Thanks to everyone who shares MFG with their network. Every other week, I share 1 interesting thing from my week, 3 actionable marketing insights that have helped me become a better product marketer, and 5 pieces of marketing that caught my eye.

ICYMI: In my last issue, I wrote about how to use switching costs as a competitive advantage (like Threads is doing), why you should review your user journey often, and more.

This week, I review AfriChange’s sign-up/onboarding process and share why the chance of winning N300k wasn’t enough to sustain me through the sign-up process. I also write about customer research, competitor research, and identifying your users’ trigger moments.

P.S. I’m trying to get to know MFG’s readers more. Could you answer a few questions in this short form if you haven’t yet?

Also, if you’d like to join MFG’s WhatsApp group — please reply to this email with your phone number or drop a comment.

Let's dive in!

🔑1 Interesting Thing

Over the weekend, I attended Founder’s Connect Live in Lagos and had an amazing time. During the event, there was a networking session, with a nice twist + a cash prize from one of FC Live’s sponsors, Africhange.

With prizes of up to 300k naira, my interest was immediately piqued and I downloaded the app and began signing up. Here’s the interesting thing though:

Despite the chance to win up to 300k, I did not complete the sign-up process. In fact, halfway through the process (while at the event), I uninstalled the app.

Why?

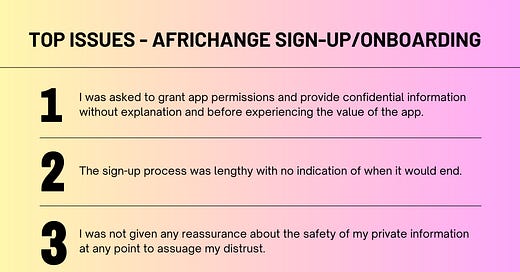

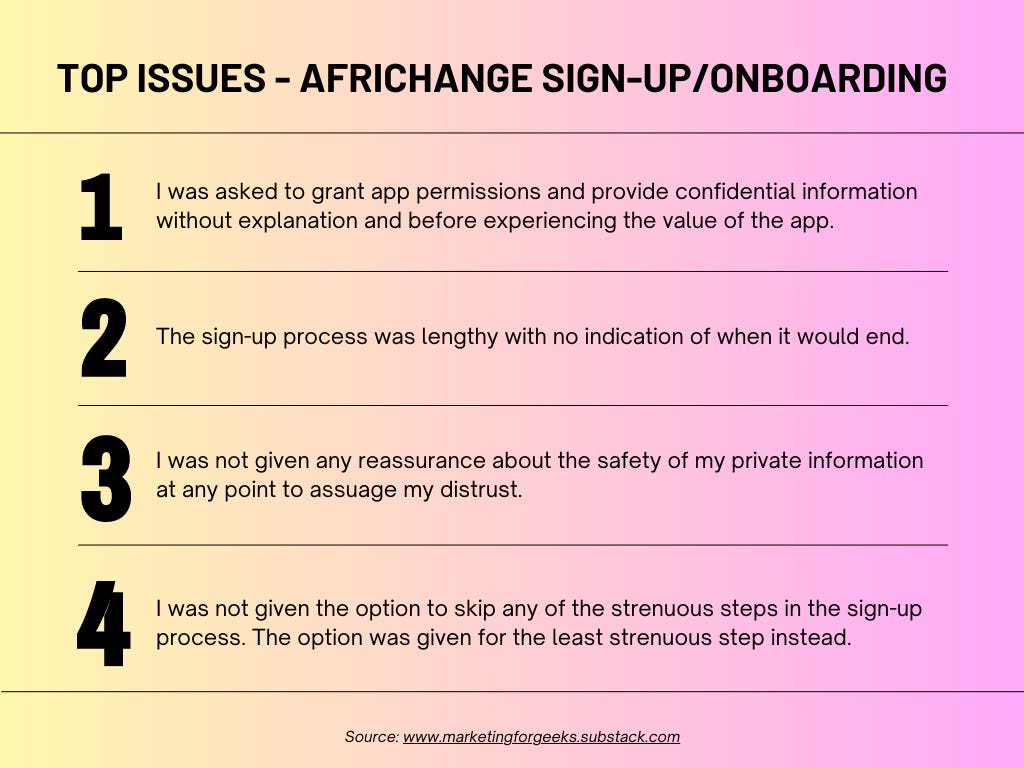

Because of these issues, I uninstalled the app and didn’t participate in the networking bingo game (but participated in networking alone) even though there was a great motivator. While at the event, I made up my mind to document these issues by conducting a product teardown (my speciality) and making recommendations to help Africhange ease this process.

To keep this issue short, I have created a presentation detailing my onboarding experience with Africhange, which you can access by clicking the button below. If you do one thing today, I recommend reading through the full teardown.

The short of it is that onboarding is a “make or break” moment that’ll determine whether users activate with your product. However, for financial apps, verification is a crucial process for regulatory purposes and to avoid fraudulent activities within your app.

To ensure an optimal process, you need to avoid overloading your user with information and processes when they have not even begun to experience any value from your product. In a competitive space like fintech, where there are hundreds of products offering the same value that you’re offering, it’s a lot easier for users to churn. This means you need to do a lot more work to activate users and keep them from churning.

There is a sweet spot, where you can provide a pleasurable onboarding experience for your user while ensuring verification that ticks your boxes. But it’s a hard spot to find, and you might have to do some trial and error, conduct user tests, and give upfront value to users. I highlighted some recommendations in the product teardown that I think would be useful for any product (fintech or not) looking to ease user onboarding and cut down product friction.

P.S. This teardown was done in good faith and is not to dismiss Africhange’s efforts. It’s why, for each problem that I pointed out, I provided recommended solutions.

TL;DR (Too Long, Didn’t Read): Onboarding processes are your user’s first interaction with your product. However, verification is an important process for regulatory purposes. You need to hit the right spot with your onboarding process, so you can verify your user without losing them.

📣Tweet this.

💭3 Insights

#1. Qualitative research should guide quantitative research.

There are two types of research — quantitative & qualitative.

Quantitative Research (e.g. surveys, experiments): Focuses on finding statistical trends through numerical data. This type of research typically requires a large sample size and allows you to collect more data in shorter periods. Quantitative research lets you make broad generalisations (e.g. 20% of Nigerians are…)

Qualitative Research (e.g. interviews, focus groups): Focuses on finding deep insights through descriptive data. This type of research takes a longer time to collect and allows for deep probing. Qualitative research cannot be used to make broad generalisations about a group of people but can help you uncover unique experiences.

If you’re a long-time MFG reader, you already know that customer interviews are one of my favourite things to do. Don’t get me wrong — they’re time-intensive and can be quite stressful, but the insights I get from them are typically invaluable. However, it can be tough to get large data samples from customer interviews. The largest number of people I’ve interviewed on a single subject matter is 12 (I think) and it took over a week to conduct the interviews and about 3 days to map the insights and draw conclusions.

On the other hand, with surveys, you can get responses from 100 people within a single day and map insights in hours. However, it can be tough to decide what kind of questions to ask in surveys or to decide on dropdown options. This is why so many surveys use open-ended “fill-in-yourself” questions.

The problem with this is that respondents are typically turned off by questions that require them to write in answers, as opposed to choosing from a list. I personally have dropped off from surveys that have open-ended questions that require me to think (and I’m speaking as someone who LOVES filling surveys). On the researcher’s side, it’s also much harder to analyse data from open-ended questions.

If you want to do comprehensive research and get the best results, I recommend conducting customer interviews first and using the insights from those interviews to guide your survey design.

For example, after interviewing 7 HR professionals and people managers, I could identify common problems they faced. This data could then be used to create a list of common problems faced by HR professionals that survey respondents could easily choose from. This would give you better responses (that are easier to analyze) from a lot more people.

Qualitative research could also let you know if you’re asking the right questions and give you a hint as to what questions you should be asking instead.

TL;DR: When doing customer research, conduct qualitative research (e.g. interviews) first and use the insights from it to design quantitative research (e.g. surveys).

📣Tweet this.

#2. Using competitor products will give you an advantage

In MFG #03, I said that you need to use whatever you sell.

Today, I’m saying that using competing products can help you get an edge over the competition. It’s the most effective way to do ongoing competitor research because you can see first-hand where your competitors win over you and where you win over them.

When most people conduct competitor research, they do it one time and consider areas like social media, pricing, positioning, etc. These are all great areas to focus on in competitor research, but they won’t give you the full picture. They won’t tell you why people choose your competitor, and you won’t find the deep truths you need to build amazing and insightful comparison pages (like I mentioned in MFG #08).

When you use competing products, you can conduct ongoing research and see minute details like loading times, customer support handling, new features, and email flows sent. These are details that a one-time competitor research will not provide because they change over time and are often best seen by long-time users (e.g. newsletters).

It’s a lot easier to steal customers from your competitor when you know what exactly you’re stealing them from. You can better position yourself as the superior product because you understand the specific things you do better. You will also be able to optimise your product better when you know what things your competitors are doing better than you are.

If you’d prefer anonymity, you can assign a member of your team for this purpose or simply use a burner email to sign up.

Of course, you also have to be careful not to copy exactly what your competitors are doing. The goal here is not to blindly copy your competitors, but to learn how you are (or can be) better than them.

P.S. If you’re looking for a competitor research template, I shared one in MFG #09.

TL;DR: Using competing products is an easy (and effective) way to do ongoing competitor research. You’ll see how you win over competitors and how they win over you.

📣Tweet this.

#3. There are often trigger events that make people seek out products.

There are often unique circumstances that make users decide to use or pay for a product. Some types of trigger events/moments include:

Economic/legislative circumstances: Sometimes, government policies or economic situations can change people’s circumstances, causing them to find solutions. For example, because of the cash scarcity caused by Nigeria’s Naira re-design, people trooped to fintech platforms like OPay and PalmPay. Another example is people choosing more affordable options during periods of economic recession or inflation.

Milestone changes: When people hit certain milestones, they may seek out solutions to celebrate those milestones or to meet the new challenges caused by those milestones. For example, when a couple gets a child, they begin to buy items that are relevant to child-caring, e.g. diapers, cribs, etc. When someone moves from Nigeria to the UK, they may suddenly be in need of international money transfer apps.

Competitor dissatisfaction: You probably saw this image of Tumblr “trolling” Twitter at some point in the last two weeks.

If people are dissatisfied with a competitor, chances are that they’ll troop en masse to a similar product instead.

Technological advancements: When there are technological advancements, some users begin to seek solutions that use these innovative approaches. For example, with the surge of Artificial Intelligence tools, some users may seek products that adopt AI to ease manual efforts.

Seasonal/Time-based triggers: Some triggers only occur during certain days, times, or seasons. For example, when it rains, people need umbrellas. It’s why sellers of nylon raincoats suddenly appear the moment dark clouds appear. Another example is school resumption season when products begin to provide “back-to-school” packages and offers.

Once you identify the trigger event(s) that make people troop to products within your niche, it is easier to position yourself exactly at the moment where your product is most needed. Like with the raincoat sellers, you can appear exactly when your customers need you.

You can also identify the patterns that lead up to the moment when customers need you and begin selling to them before they even experience the trigger moment. If you sell baby clothes, you can target people who Google things like “Baby name ideas” “Foods to avoid during pregnancy” “How long does morning sickness last” etc. I can't remember the exact brand but a couple years ago, I read about a luxury automobile brand that successfully ran ads targeting LinkedIn users who had recently gotten a promotion. The idea was that people who get promotions are likely to seek a commensurate lifestyle change to reflect their new salary level.

There are various ways to identify your customers’ trigger moment:

Ask existing users what event happened in their life that made them choose your product or what they were doing when they decided to use your product.

Monitor competitors closely and swoop in at the moment of customer dissatisfaction. P.S. This is why you need to use competing products, so you can easily identify the points of customer dissatisfaction and prepare your “attack”.

Keep your ear to the ground on relevant events and news, within your industry, your customers’ location, and around the world at large.

TL;DR: There are typically trigger events that push people to use your product. If you can identify those moments, you can engineer your positioning and appear to customers at the exact moment when they need you.

📣Tweet this.

⚡5 Pieces of Marketing

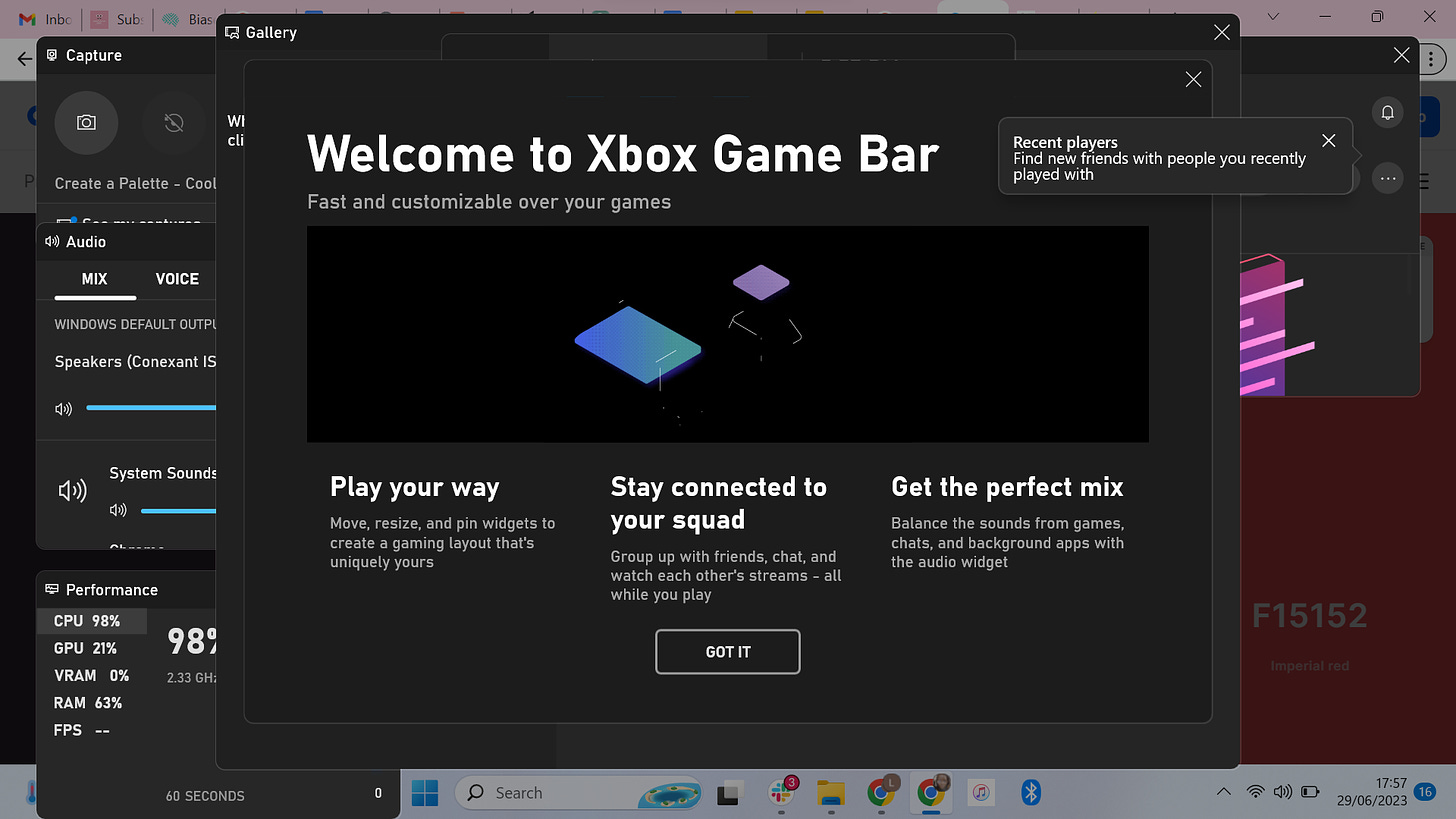

#1. Xbox’s Game Bar👎🏽

When you open Xbox’s Game Bar on PC, about 5 different screens open up at the same time, and you have to close each of them manually.

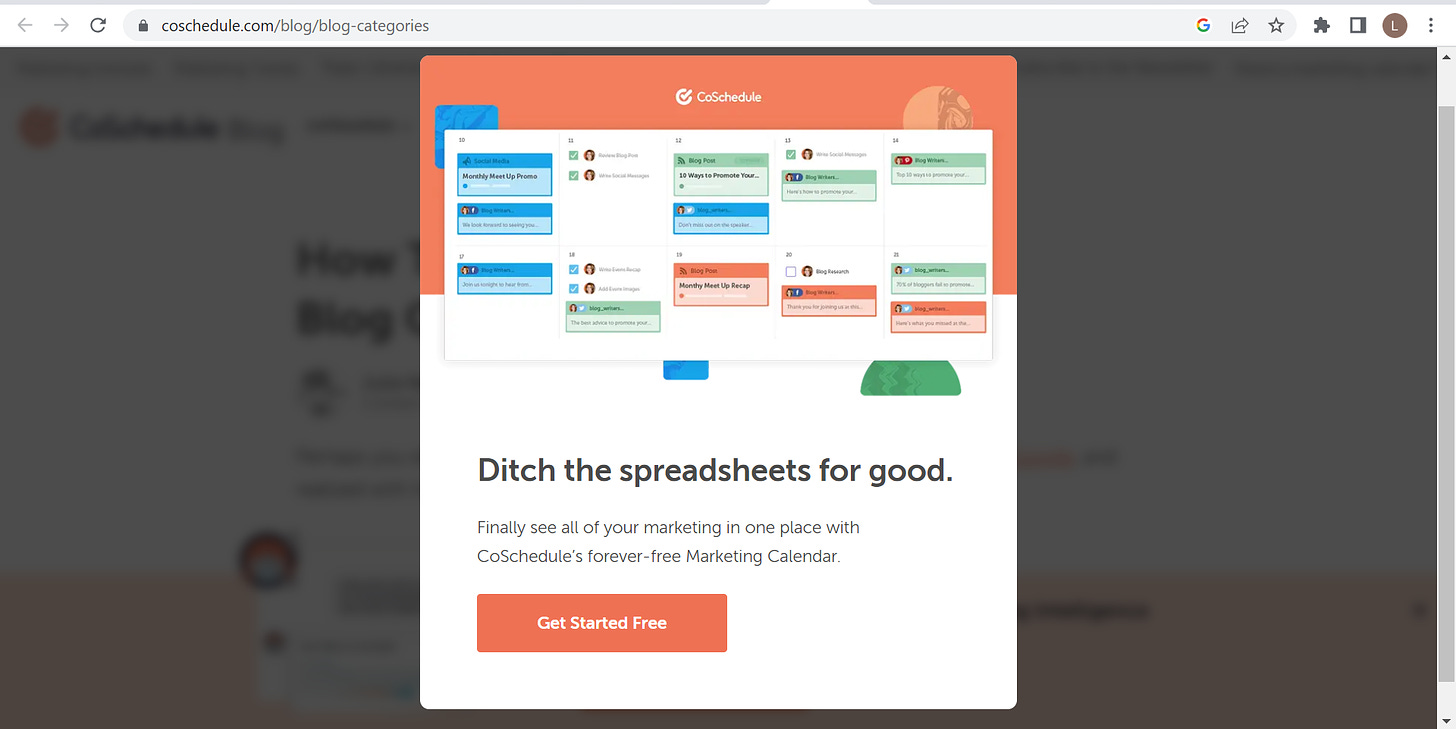

#2. Coschedule’s Pop-Up👍🏽

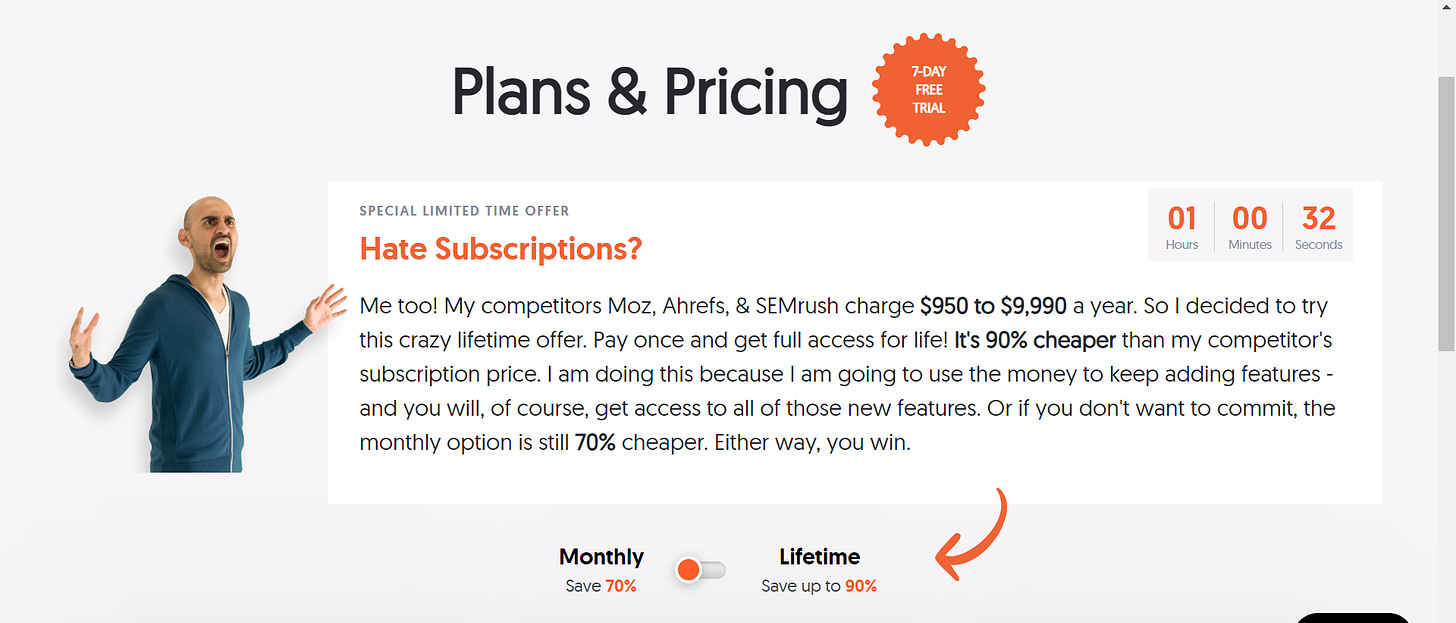

#3. AnswerThePublic’s Pricing Pop-Up👍🏽

Directly speaks to competitors’ pricing.

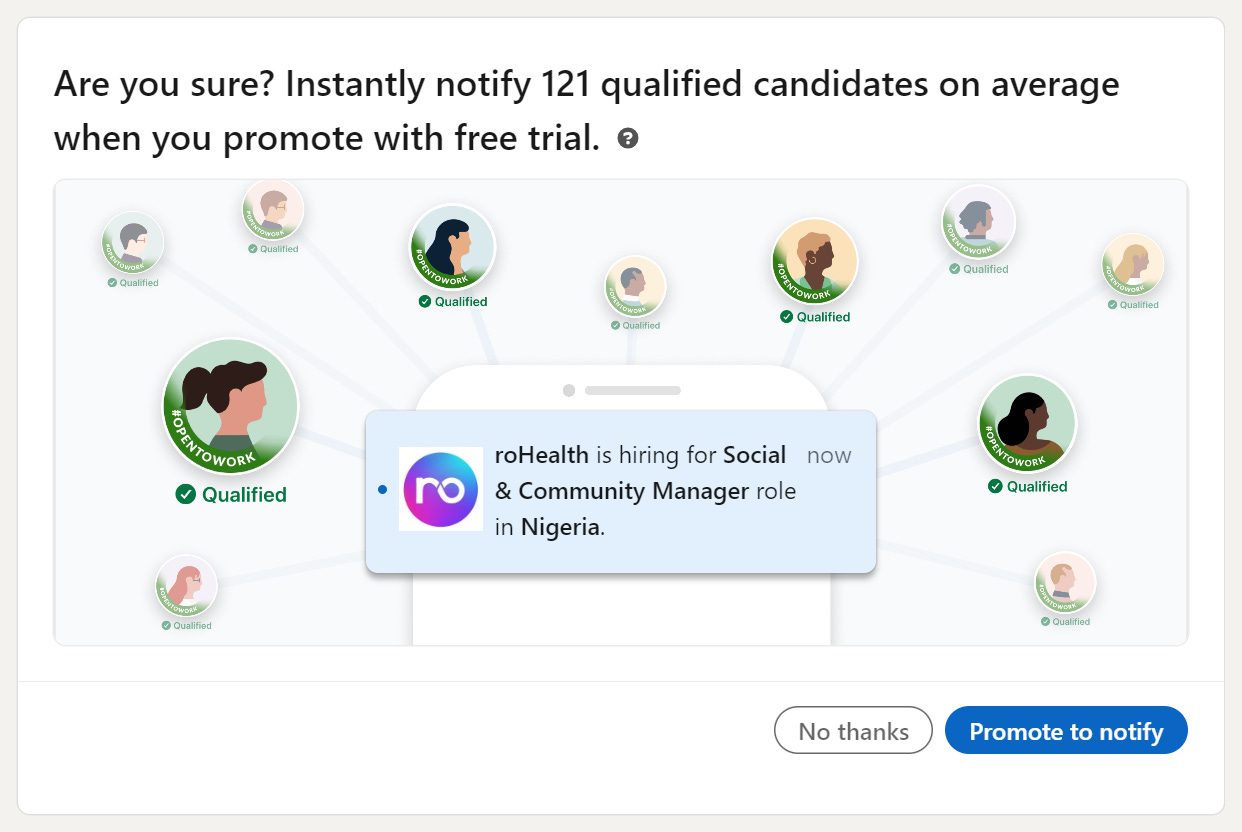

#4. LinkedIn’s push to pay for job promotions👍🏽

Great that they specifically mention the number of qualified candidates you could get if you promote. They also hint at the speed with which you’d get responses.

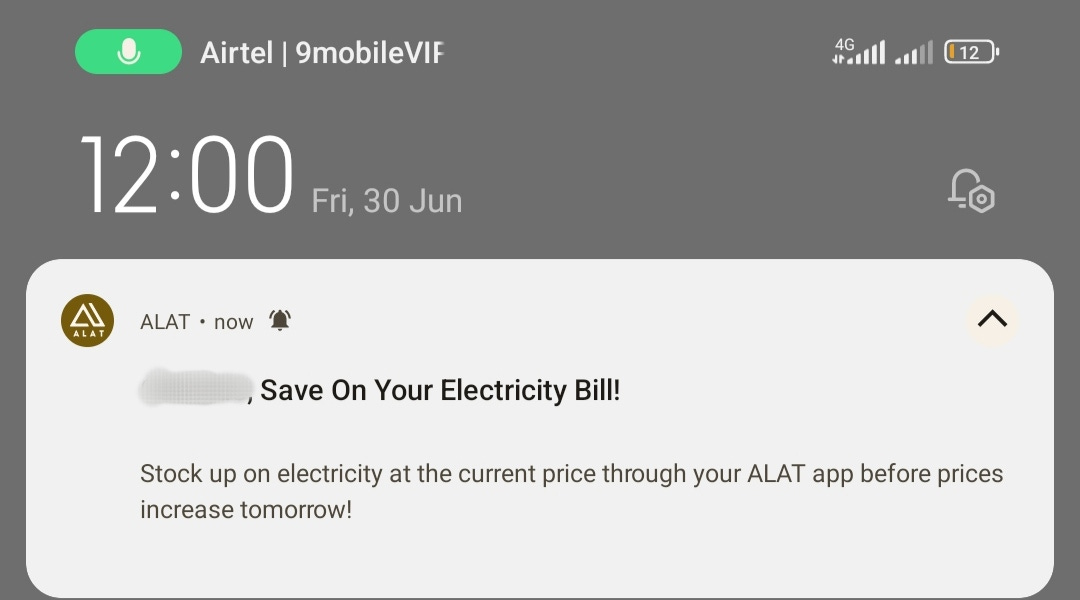

#5. Alat’s Push Notification👍🏽

For context, the Nigerian Electricity Regulatory Commission announced plans to increase electricity tariffs by July 1. This was a very timely notification (came on June 30, a day before the proposed increase), taking advantage of a trigger moment for customers.

What I’m Reading

A Founder’s Step-by-Step Guide to Getting Your First 1,000 Community Members — Interesting article for anyone leveraging community-led growth, especially at the early stage.

The Looking Glass: Fear of What Others Think — Step-by-step guide on how to build product intuition (good read for product managers, founders, and product marketers).

Neal.Fun — Not a read, technically. It’s a site filled with mini-projects that can help you if you’re looking for something to do on the internet when you’re bored.

What 5 years at Reddit taught us about building for a highly opinionated user base — A framework for turning a sometimes combative relationship with users into a strong, productive partnership.

When Branding is a Growth Strategy — How to leverage a brand investment to transform your business (A Patreon story).

Bruvvv, this was so educative and practical. Thank you Lade, I loved the examples mehn.

Would like to join the WA group - 08097820605