Marketing Geeks Speak: On Branding & Verification Codes

Some of the most insightful responses to the last MFG issue (MFG #10)

Hi there.

Welcome to the 93 new subscribers that joined Marketing For Geeks since the last issue. Thanks to everyone who shares MFG with their network. Every other week, I share 1 interesting thing from my week, 3 actionable marketing insights that have helped me become a better product marketer, and 5 pieces of marketing that caught my eye.

P.S. I’m trying to get to know MFG’s readers more. Could you answer a few questions in this short form?

ICYMI: In my last issue, I wrote about OPay/PalmPay’s non-existent branding problem and friction in email verification:

MFG’s last issue was the most popular yet — 1k+ views and counting. I received a few insightful comments and counter-arguments about the issue, which I thought were interesting.

Introducing Marketing Geeks Speak

So, I’m starting a new section called Marketing Geeks Speak — which is what you’re reading right now. One week after every Marketing For Geeks issue, I will share the most insightful responses I got to the previous issue. This way, we keep the conversation going and you can see new angles or info about previous insights.

If you’re already a subscriber to Marketing For Geeks, you don’t need to take any new action. Everyone who is subscribed to Marketing For Geeks will automatically get added to both the main issue and this new section (Marketing Geeks Speak).

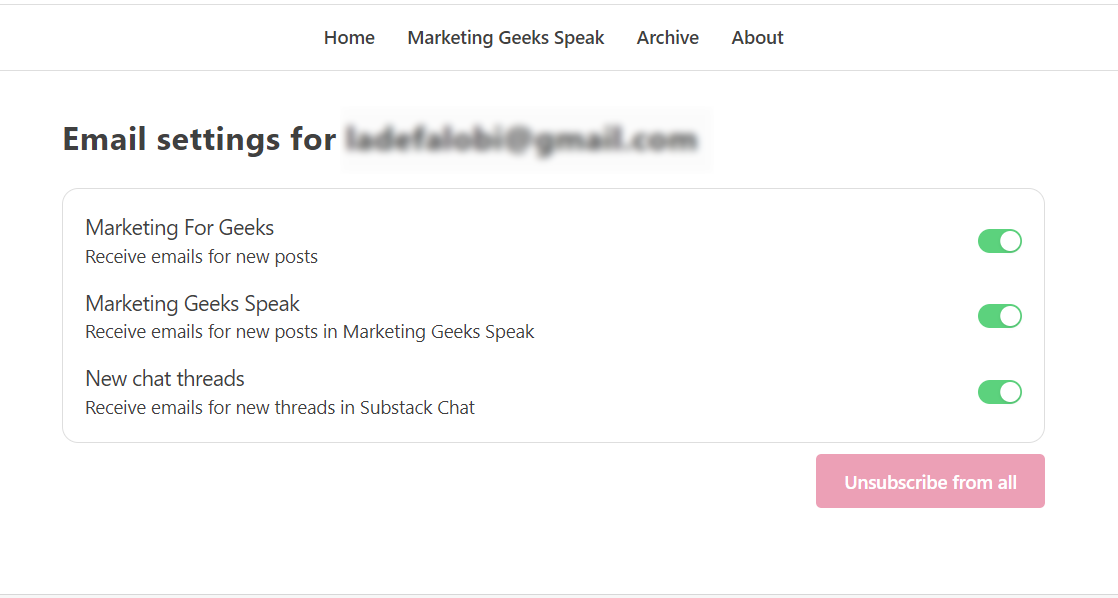

However, if you’re only interested in receiving the main MFG issue, you can click the “Unsubscribe” button and you will get directed to a screen like the one pictured below, where you can unsubscribe yourself from Marketing Geeks Speak, without losing your subscription to Marketing For Geeks.

That said, let's dive in!

On OPay & PalmPay

Temilade Praise agreed on some things:

“Love this fresh perspective on Opay and Palmpay's branding. I started using them during the cash scarcity earlier this year. Kuda became unreliable during that period and I just downloaded both of them as an alternative and sent some petty cash to both of them to avoid wahala when I'm out. After using the app for a couple months I've realized that they're both better products than Kuda and all the other bank accounts I have (10+)😅. They have unlimited transfers, interest on savings, loans and loads of discounts.

One thing I've noticed is that a lot of strategies that I see and use in e-commerce and B2C marketing are clearly on display on the app. And it makes it an overall better product. And they definitely do a great job on all those goals.

Brand recognition✅

Credibility✅

Loyalty✅

Consistency✅

Advantage✅

Another big strength for Opay is their agent network. Especially during their early stages when the product wasn't as refined. The agents served as human onboarding of some sorts before they were able to champion self-service.

Another important one I think is worth mentioning where they excel is Customer Service. Very few fintechs have good customer service. Opay and Palmpay both do. They have an extensive knowledge base that covers basically every question combined with automations and still have agents who reply fast.

Great branding brings in the leads, a great product keeps them.”

However, he thinks there’s a missed opportunity there:

“But given how great their product is, I think they can benefit from creating a sister brand that targets users with a higher income.

If majority of the folks with higher income and recurring income like salaries aren't comfortable using it, it might not be a branding problem but I still think that's a missed opportunity.”

Gabrielle Harry testified to OPay’s WOM growth:

“You’re definitely right about OPay’s biggest strength being their evangelical customers. The first time I heard of Opay was when I went to do my nails last year and the nail tech randomly started talking about how good they were. Unprovoked o!

Honestly, I feel like that kind of impact on customers is only attainable when the service is impeccable. The product recommends itself.”

Gabrielle also made some good points about brand reputation:

“I don’t think I’ve ever seen an OPay ad. Compared to a brand like Chipper which employs aggressive marketing (literally feels like their ads were knocking my head at one point), OPay is way more low-key. This is also probably because they understand their user base and know where to advertise.

This also makes me consider that one of the consequences of aggressively marketing a product that isn’t quite there yet is negative brand recognition, and that can be almost fatal for a business like a fintech which desperately needs users to trust the brand.

As for Palmpay, it’s today I’m learning that it’s not just a loan app💀. I actually think their reputation for doggedly chasing down debtors might actually have a certain stigma, leading to negative brand recognition.”

Edaki Timothy posed an interesting question:

“One of the reasons for Opays' growth in the past months has been their functional product - transfers work, making payment is seamless and without hitch (i bet a good number if consumers didn't even use opay until the cash crises) -

Hypothetically, if every other financial partner gets what opay is doing right - on a functional basis, do you think there would still be a market for them? Since consumers buy brand when the 3As work.

If GTB and kuda and the likes have a functional product (the basis on which opay works currently), wouldn't consumers switch back to them and leave opay because these guys have branding.

So, doesn't the branding problem still exist?”

My response:

“That's a really good point actually. In that hypothetical, OPay and PalmPay might not have the same market share that they do. A chunk of the upwardly mobile or tech savvy audience that switched to OPay/PalmPay because of its functionality will likely not have switched if their existing banks were doing a great job.

That's why I said branding can only be a differentiator in a market where product quality is largely the same across competitors. So, in the hypothetical situation you mentioned, branding would definitely become a more important factor. A real life example:

When GTBank did it's *737# campaign and started doing events like Food & Drink Festival, it was very effective because most traditional banks were doing the same thing. There was no major differentiator among banks for the large part. So, branding became a differentiator for GTBank and they won younger audiences.

But the same example goes to show that branding can't take the place of a good product. Because by the time fintechs started popping up and building better products, branding could no longer work as a differentiator. And now, no amount of branding will bring back the customers that GTBank lost to OPay/PalmPay. The only solution would be a better product (or if OPay and PalmPay suddenly pack up).

So branding is really only a temporary solution”

His counter:

“Love the line on branding being a differentiator where product quality is the same, but opay/palmpay don't have that branding now, we can all agree.

Even if they retain their intended consumer base, consumers are aspirational - so, why stick with the guys on their level when they can switch to a classier bank that offers the same products?

I mean, that's why people wear the wrong spelling of adidas and balenciaga footwear - because they're aspirational and want to belong. If consumers think like this, Opay would exist as first movers perhaps for great functional product (and Eyowo even has first mover advantage over them), but they'll lose out on a good deal of customers.

What does Apple have going for them if not branding and positioning? It's not the product that necessarily sells, it's the brand.”

On Email Verification

Adekoyejo Olatoye (of Krave) shared a different experience with verification links:

For verification links, my experience has been different. Infact verification links is more of a friction for me than codes. Anytime I click the link sent to my email, I lose the data I already filled and most times have to fill again.

Except when the link is the last thing in the onboarding process. Fintechs won’t really have that issue though cos they use BVN or NIN for verification of the user’s details”