📈Inside Risevest's Growth Playbook That Took Them To 600k Users

Olamide Adurota, Growth Lead at Risevest, shares how Risevest builds user trust and manages experiments to move users along the funnel.

Hi there.

Welcome to the 99 new subscribers who joined Marketing For Geeks since the last issue. Big thanks to everyone who shares MFG with their network.

Every month, I share 1 interesting thing, 3 actionable marketing insights that have helped me become a better product marketer, and 5 pieces of marketing that caught my eye.

P.S. I’m trying to get to know MFG’s readers more. Could you answer a few questions in this short form if you haven’t yet? Also, if you’d like to join MFG’s WhatsApp community, please fill this form.

ICYMI: In my last issue, I wrote about how to use the 7 principles of persuasion to improve conversion, the 3 types of B2B personas you need to create, and how to use compounding strategies to create MoM growth.

Today, we have a Funnel Vision issue, where I do a deep dive into a specific campaign, project, or product by speaking with the marketing professional behind them.

In this issue, I look into Risevest’s growth marketing strategy with Olamide Adurota, Growth Lead at Rise.

Let's dive in!

How Risevest Manages Full-Funnel Growth Experiments

At the Builder’s Summit last weekend, a speaker asked how many people at the event used Risevest; and hands shot up across the room. In a country whose currency value is constantly crashing, Risevest allows Nigerians to protect against inflation with dollar-denominated investments.

Today, Risevest has over 600,000 users and has paid over $42M out to them. A big part of Risevest’s success is its growth experiments, which are managed by Olamide Adurota, their Growth Lead. I’ve been looking to feature Olamide in Marketing For Geeks since last year, and this was the perfect opportunity.

So, what does Risevest’s growth funnel look like and how do they manage success and failure?

Marketing vs Growth

Marketing can be a dizzying field and it can be tough to decide what buckets certain titles fit under. For Olamide, who has a dual reporting line to the Head of Marketing and Risevest’s CEO, the difference is clear. Marketing is broad and typically relies on efforts within the marketing team alone. But for growth, you have to work with whatever team is needed to achieve your specific goals at the time. Sometimes, that’s the marketing team; sometimes it’s the product team; sometimes it’s the engineering team or the sales team.

This means that Olamide has to work across multiple teams, depending on what solution he’s looking to implement or what problem he’s trying to solve. When he runs TOFU campaigns and needs ad content, he collaborates with the marketing team. When he needs a direct integration for a tool, he works with the engineering team. When he runs an in-app experiment, he and the product manager rub minds.

Working with so many teams can be difficult, but it’s easier for Olamide because he’s multi-dimensional.

“When you're multidimensional–when you have knowledge of different areas like marketing, product, sales–you can interact seamlessly with different teams. I can also interact with the data team because I also have some foundational knowledge of data. I understand how I want the data infrastructure of the product to be, the tools we need to implement, how we need to pass the data from one to the other, and how data needs to be collected on the app. It’s the same for other teams. That knowledge makes it easier to interact.”

This doesn’t mean the road has been sunny all through. When he first started at Risevest, he had to immerse himself in their technical processes and principles. The Head of Engineering gave him insights into their existing data infrastructure, which he then used to set up the tools he needed and shaped how he made requests going forward.

Olamide doesn’t always directly work with developers. He and the product manager typically collaborate and the product manager then translates his requests to the developers. But sometimes, he joins engineering standups when they need extra context or have specific questions about his requests.

Experimentation at Risevest

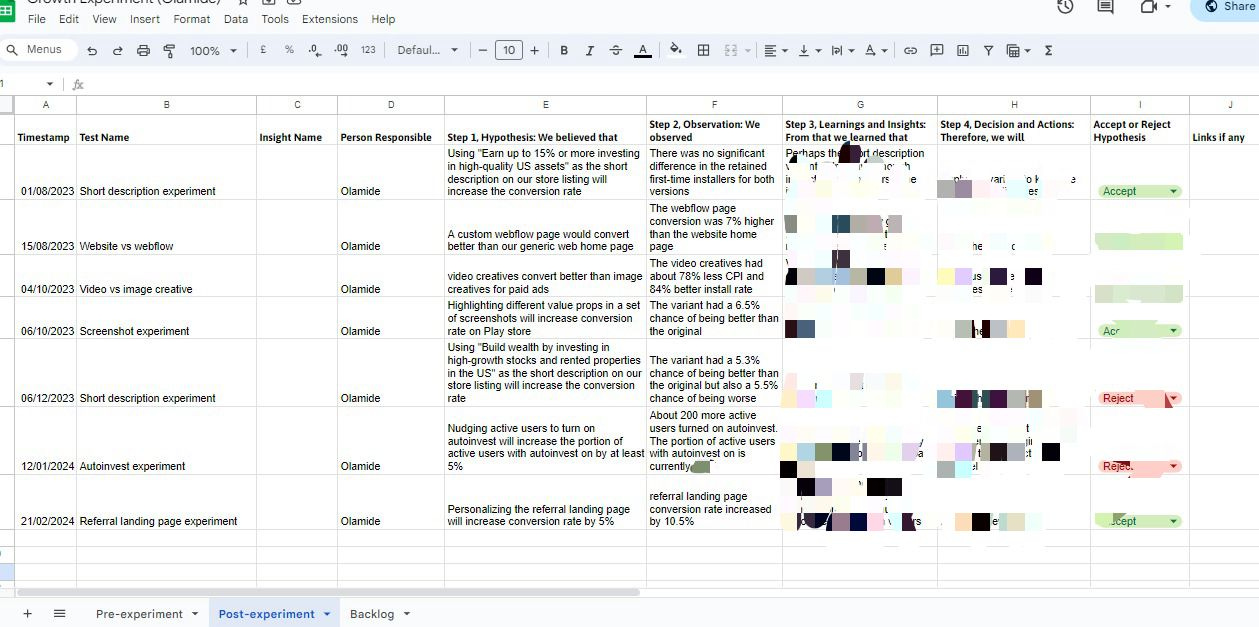

Experiments are a big part of Risevest’s culture, and Olamide’s day-to-day involves making and testing hypotheses. Olamide keeps track of his many experiments in a Google Sheet.

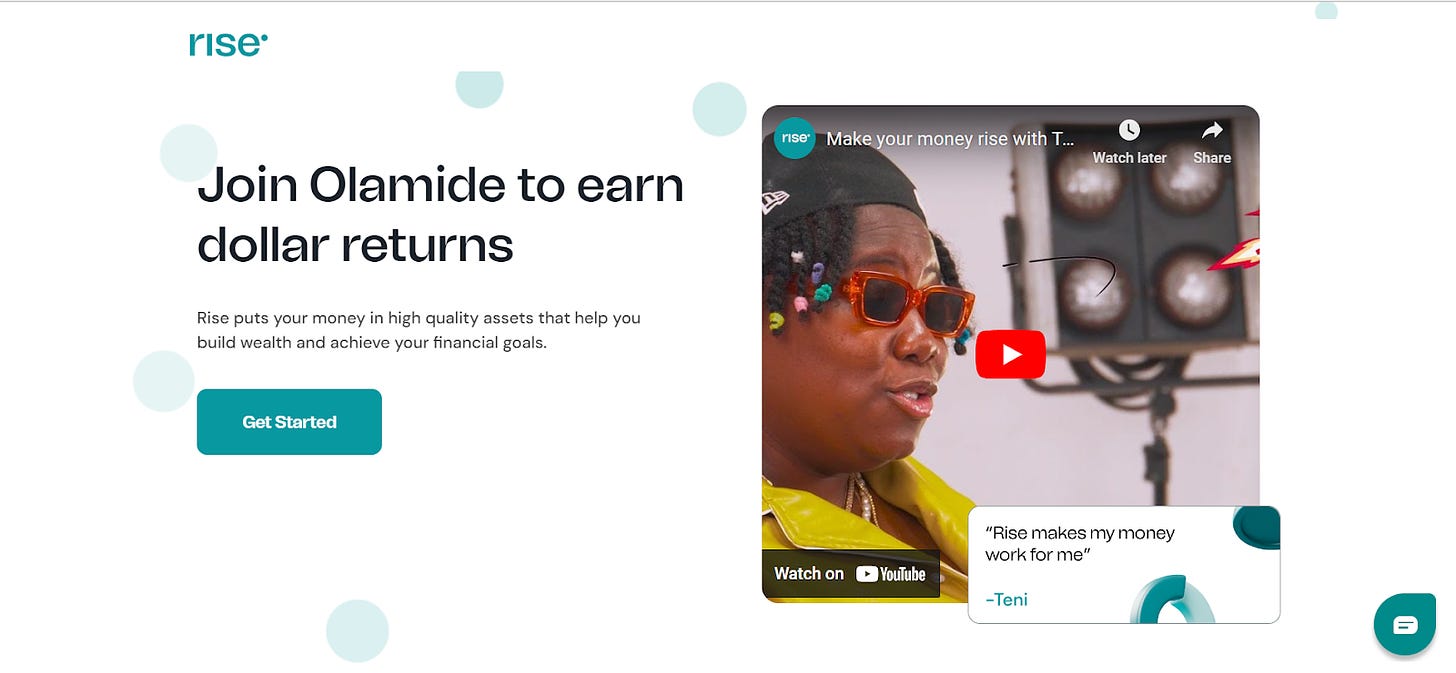

One of the experiments Olamide is most proud of is the one he ran for Risevest’s referral program. He made one tweak to the referral landing page, and it resulted in a 10.5% increase in referral conversions, exceeding his initial goal of a 5% increase. The tweak? Customising the referral page with the first name of the referrer.

It’s not all roses though. Some experiments are amazing successes; but others turn out to be failures despite your best wishes.

For example, Olamide discovered a positive relationship between the adoption of Risevest’s auto-invest feature and an increase in Assets Under Management (AUM). So, he launched an experiment to test if an increase in adoption of the feature would lead to an increase in AUM. He created engagement messages to validate his hypothesis and it fell short of his goal. Now, he’s testing the hypothesis again, but with a different solution.

That’s just one of the many times that Olamide has had to pivot quickly from failure. It's the least enjoyable part about his job; that he has to be comfortable with failing.

Video Source: Risevest YouTube

Olamide also takes some comfort in collaborating with the marketing team during their weekly calls. During those calls, he's open about what failed or didn't fail: and the whole team brainstorms on what to do next.

These experiments have yielded great results for the company. By tweaking different ad variants, Olamide and his growth associate were able to reduce Risevest’s Cost Per Acquisition by 73% and achieve a10-20% MoM user growth.

Tracking Success

Data is one of the most important pillars of growth, so it’s only natural that Olamide has clear processes for tracking success with data.

For acquisition, he tracks sign-ups, installs, and Cost Per Acquisition (CPA). Risevest runs acquisition campaigns across multiple channels (Google, Twitter, Meta), so it’s very important that Olamide knows which channels or campaigns are scalable or that draw in the best users.

For activation, he tracks the activation rate and Customer Acquisition Cost (CAC). It’s important to track CPA separately from CAC, so you know just how much you spend to acquire active users. Risevest had already established their activation metric before Olamide joined in, but he agrees with them about what an active user is. As he explains, activation should be based on the action that gives users value and indicates product usage. For Risevest, that is when users fund their wallets for the first time.

It’s one thing to get a user to fund their wallet; it’s another for them to use it consistently and adopt it. That’s why Olamide monitors product adoption and usage. Certain key actions within a product help signify adoption. In Risevest’s case, those key actions include using the auto-invest feature and creating or funding an investment plan. Tracking these actions means that Olamide can better understand user behaviour and nudge users to get the most value from the product.

You can read more about product adoption in MFG #09:

But perhaps, some of the most important metrics are the revenue metrics. The most important of these is Assets Under Management (AUM) because Risevest is an investment company. He also monitors the Average Revenue Per User (ARPU) and the LTV to CAC ratio.

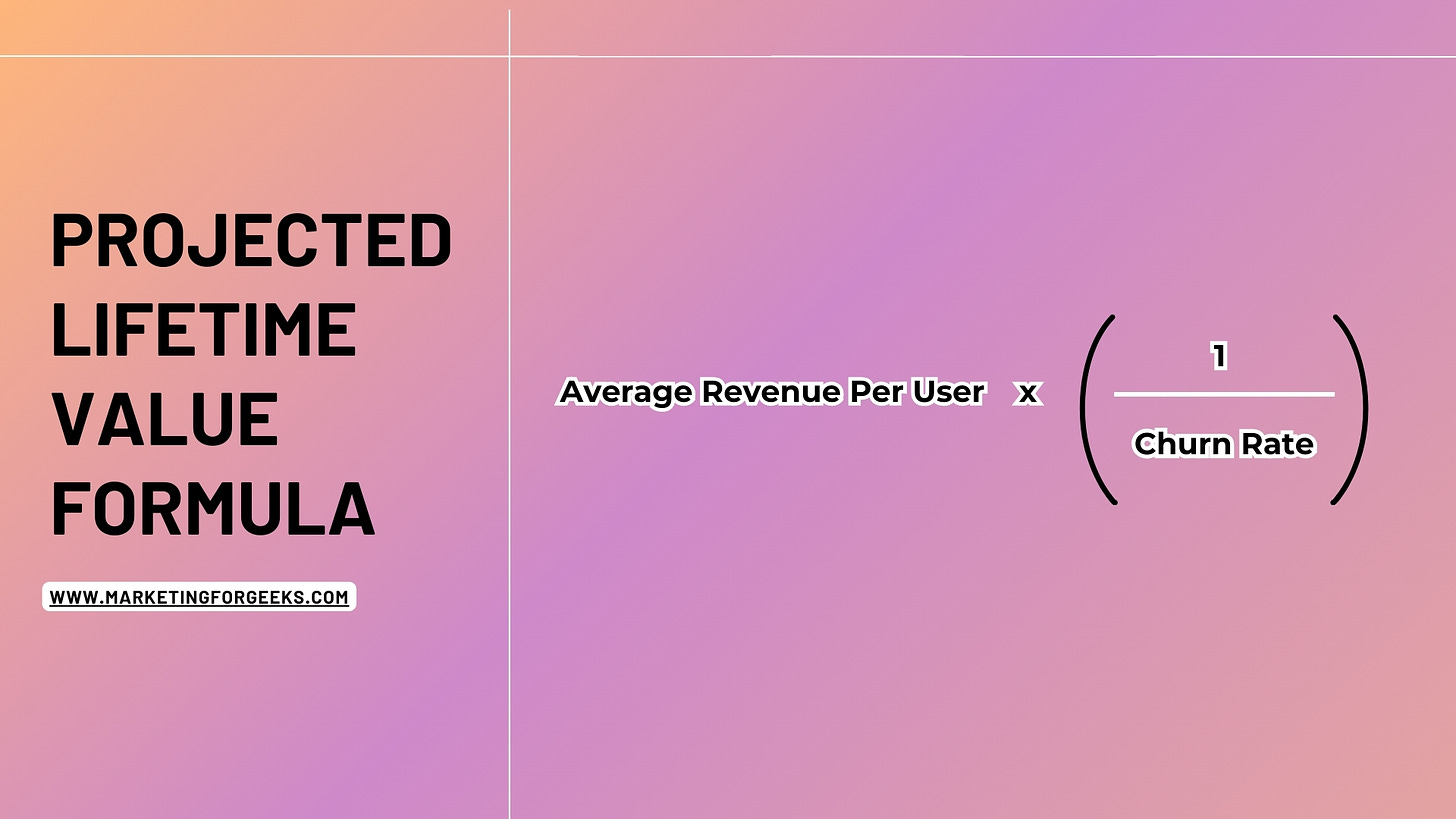

Lifetime Value (LTV) is a tough nut to crack, and there are many different ways of calculating it. Olamide graciously walked me through the formula Risevest uses, which calculates a projected lifetime value as a function of your churn rate and average revenue per user. Here’s the formula:

Finally, Olamide reviews the churn rate. At Risevest, there are two definitions of churn. The first is when a user hasn’t funded their wallet in 60 days. The second is when users withdraw all the money from the platform. This is because as an investment platform, active users are defined by those with Assets Under Management.

He and his team recently ran an RFM (Recency, Frequency, Monetary) analysis to rank customers and predict new user behaviour based on existing user behaviour.

“We wanted to identify our best users and our worst users. For recency, we looked at users who had funded their wallets in the past 30 days. For frequency, we looked at users who had funded consistently for at least 6 months. For monetary value, we looked at users who had funded a certain minimum amount each month for those 6 months and had a minimum amount in AUM.

The combination of these conditions gives us a list of users we can consider our best users. The next step for us is to look at their data to understand more about them, like what channels they came from. The RMF analysis basically informed the rest of our strategy and experiments. For example, this gives us an idea of what acquisition channels to possibly prioritise that could yield more users like them.”

With so many metrics to track, I had to ask Olamide how exactly he keeps track of them. His major tool is Amplitude, which he uses for product analytics. Amplitude also has a Customer Data Platform (CDP) that lets him connect his data sources together. For example, he passes attribution data from AppsFlyer (a Mobile Measurement Partner) to Amplitude’s CDP, and then to Customer.io (a customer engagement tool).

He was able to build this data infrastructure with the help of the data team and engineering team. To communicate his needs, he used an event tracking sheet following this template👇🏽

In the sheet, he works backwards from the key metrics he needs to the key events and properties that inform them.

“I already know the different actions that users can take, the important actions I want to look at, and how I want to break down my data. For example, I know I want to view sign-ups by what channel they came from or by their age group. So I make sure to include the user source as a property in my tracking plan”

Having a data team has really helped Olamide do better and quicker work because he can just ask the data team to run queries and return a list of users that fit his criteria.

“It’s a net positive. Without data, you’re sitting in the dark. When I’m trying to make a decision and I need a benchmark, I need historical data to help prepare my mind. Same thing for experiments. If my tools don’t have the answer, I can just go to the data team.”

Funnel Management & User Engagement

Olamide is also responsible for making sure users move along the funnel.

There are two main ways Olamide approaches experiments for this; from a marketing angle or from a product angle.

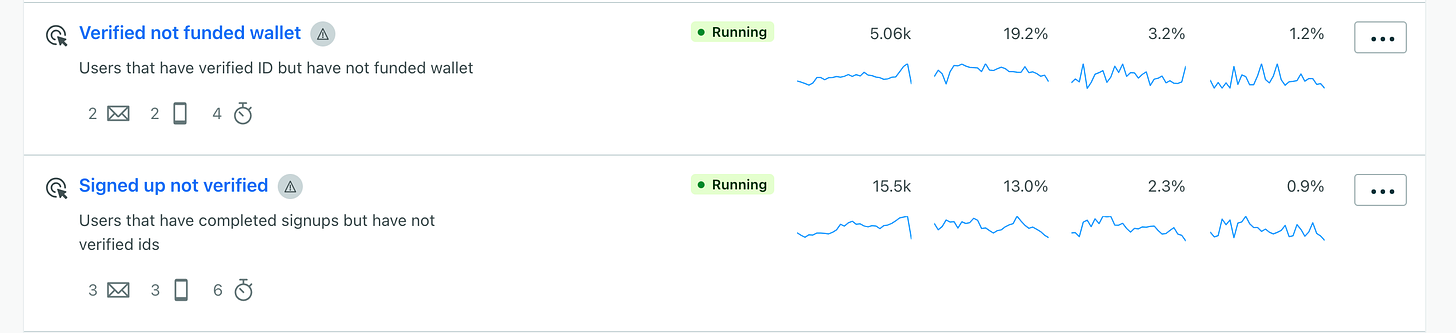

Marketing solutions include things like user engagement and communication nudging them to take the next key action. Olamide has created segments in customer.io depending on what stage users are in their journey.

Risevest has different journeys created in customer.io and they use omnichannel engagement. Not all users view emails; not all have push notifications on. So, Olamide pushes messaging across multiple channels. As the saying goes, “There is more than one entrance to the market.”

“We always try different channels because your users aren’t just on one channel. There are users who don’t check their emails, and so you can only reach them via push notification. There are those who don’t even read or allow push notification, so you can reach them via SMS. And all that just increases your chances of success.”

For the second approach—the product approach—Olamide collaborates with the product team. Marketing messages aren’t always the solution to drop-off funnels; in some cases, the drop-off is caused by a product problem.

“Your users could be dropping off because your product is quite complicated and they don’t know what to do next. There are different ways to find out what’s really causing your users to drop off. You can use external tools like Hotjar to view recordings of new users vs returning users. Returning users likely already know what to do on the app; they just do what they need to do and they get out. But for new users, you might notice them browsing around because it’s a new interface and they don’t yet know what to do next.”

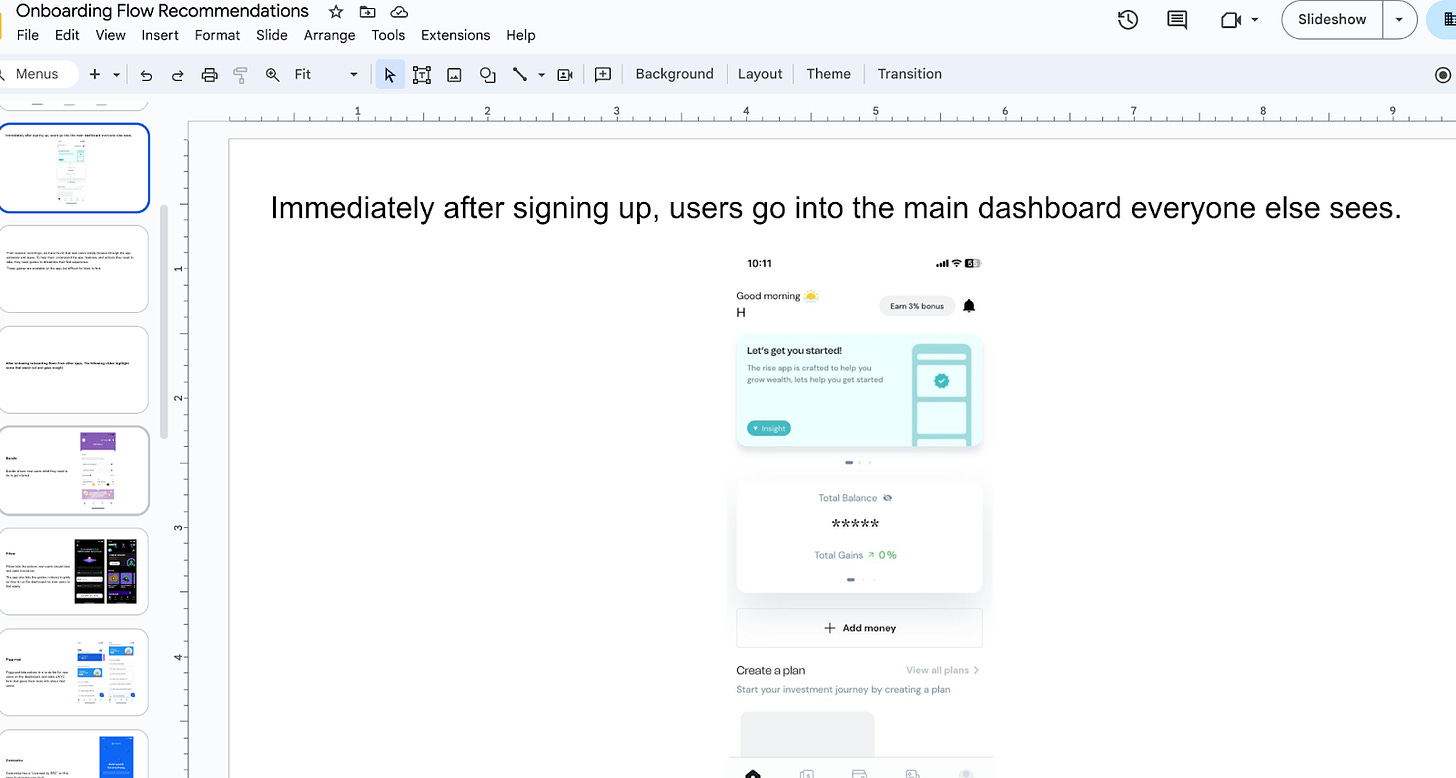

Olamide believes onboarding is an important aspect of optimising the funnel, because new users often need guidance on what to do next.

Risevest also uses customer engagement to reactivate churned users. Apart from engaging them with marketing communications, the telesales team reaches out to churned users to understand what went wrong.

What Makes Fintech Marketing & Growth Different?

Olamide has worked across multiple industries, but Risevest is the first fintech product he’s grown. Naturally, I had to ask him if he thought fintech marketing was different from other industries he’d worked in.

There are 2 main differences for Olamide. The first is in the broadness of the market. With verticals like SaaS or Edutech, you have to sell to a specific niche and you can use inbound models like SEO & PLG to draw them out slowly. In fintech though, you have a more mainstream audience and a very large market. This means, Olamide says, that awareness is very important.

“It means you need to make a lot of noise and you need traditional marketing to increase awareness because you’re trying to sell to a broad market.

You need awareness, because that helps with acquisition. It’s easier to acquire users when they’ve already seen or heard about your product.”

Speaking of fintech marketing…

Treford is hosting a full-stack fintech masterclass that covers everything from product management to data tracking and design. You can pay for all 7 classes or choose the one that best suits you.

I’ve taken Treford’s product marketing and product strategy bootcamps in the past; they were excellent.

The good people at Treford have granted a 10% discount to MFG subscribers. There’s limited slots left, and registrations close by June 10.

Okay, back to it.

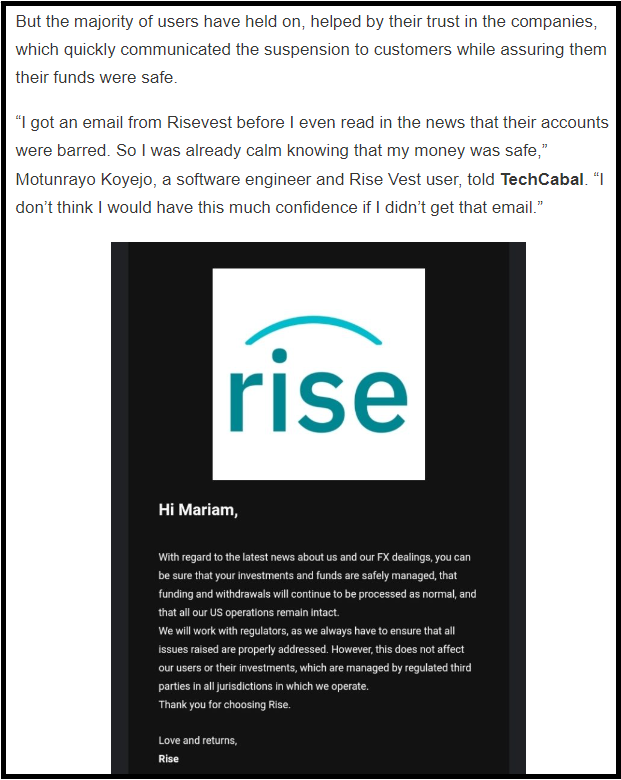

The second thing about fintech, according to Olamide, is that trust is an extremely important currency. Nigerians are distrustful people; especially when it comes to money.

“There will be concerns about whether you can be trusted or not. You need to be upfront with regulations, endorsements, and certifications. You especially need to communicate with users often. It’s normal for people to be sensitive about their money and where they put it. At Risevest, when there’s a new CBN policy that makes users worried about their money, we send communications explaining the new policy and why it doesn’t affect their normal”

The strategy works. The company has received some public acclaim for being a trusted financial partner, and they’ve grown to become the top dollar investment app in Nigeria.

That’s it! A look into how Risevest handles growth experiments from the scientist who leads them.

📣Tweet about this.

You can see more of Olamide on Twitter or LinkedIn.

What project, product, or campaign should I focus on next? Feel free to recommend a project you love by leaving a comment.

What I’m Reading

Using content to influence switching costs — I wrote about switching costs in MFG #11. This lovely issue from Akachukwu tackled the same topic, but focusing on how to use content marketing to influence switching costs. It’s a great read.

Stop optimizing for a CAC:LTV ratio of 1:3 — Why the 1:3 CAC to LTV ratio might not be the best benchmark for your business.

Why you (probably) shouldn't create a new category — A lesson in differentiation and positioning for competitive advantage.

Why data-driven product decisions are hard (sometimes impossible) — A dive into the difference between being data-driven vs data-informed vs data-ignorant, and why that matters.

Did you enjoy this issue? Give it a ❤️ and let me know in the comments section.

Even better, share this with someone.

Well done Lade. This issue was awesome

He keeps track of his experiments!!! That's brilliant!